One thing wrong with our consumer driven society is the crap on TV, including Jim Cramer's Mad Money and the Keeping up with the Jones' shows like, The Fabulous life of...on VH1.

Where I'm coming fromOur consumer driven society's

current saving level is the lowest since the government began recording this number in 1959, while the

national consumer credit outstanding revolving (credit card) debt is up to $806 billion as of June 2005. It is absolutely sickening to see facts such as these and then consider the consumer driven garbage that is on television. What about shows that could teach us the value of the basics of personal finance, not the buy/sell opinion of a TV personality?

Is it TV in general or just shows like this?I'm sure we can all come up with TV shows that are not financially prudent to watch. I think we also all know that advertisements are the biggest offender! If instead of watching TV and advertisements, we spent our time reading books on our hobbies, personal finance, or even great literary works I think our world would be better off. With regards to TV, for now I'd like to focus on Mad Money, Jim Cramer and the ill effects of active trading and preaching to to a world-wide audience.

Me vs. Jim CramerPerhaps, Jim Cramer ran a hedge fund and has other "Wall Street" experience, but I really think it's bad TV for the general public to watch TV shows like Mad Money. According to what I've found, Cramer worked at Goldman Sachs and then formed Cramer & Co., a hedge fund in 1987. "After a stellar 2000, Mr. Cramer's fund finished up the year +36% vs. -11% for the S&P and -6% for the Dow Industries. Mr. Cramer decided it was time to get out and he now devotes all his attention to TheStreet.com" and his TV show on CNBC, Mad Money. Yes, he also did graduate Harvard and Harvard Law School. This brings me to some questions I would like to answer:

Does this validate giving stock advice to millions (sorry couldn't find a statistic that shows the audience size of Mad Money) with regards to what he believes and what is not necessarily prudent for that investors personal situation? Clearly

NO, but Cramer isn't the only offender, think about the broad brush strokes of folks like Dave Ramsey. Ramsey fans don't murder me, I am merely stating that his responses to radio shows hardly dig deep enough to give prudent financial advice for that particular caller's financial situation. Ramsey does do the world some good by preaching to get rid of debt and spend less than you earn, so don't burn me at the stake. Heck, he even advocates turning off the TV and reading a book, which I definitely agree with. What I am merely pointing out is that Jim Cramer, nor Dave Ramsey, know the exact financial situation of the caller and shouldn't be giving some of the advice they give. Yes, Cramer says he is just giving advice to those that have side money and want to dabble in the market, but does he know if that person's portfolio is already overweighted in the sector that he is recommending a buy of a certain stock in that same sector?

What's Jim's portfolio record? If you take a gander over at

Booyah Boy Audit one can see an unbiased record of

Jim Cramer's Performance Scoreboard for the last month and a half. Has he beat the market?...yes (Cramer 2.11% vs. S&P500 -0.47%). Does he have a 70+ year record of annualized rates of return of 12.74% for Small Stocks (Small Cap) or 10.43% for Large Stocks (S&P 500)?

NOShould the typical investor be in and out of the market to "Back up the truck and buy" or "Sell, Sell, Sell" as Cramer's soundbites suggest? Let's rack up another

NO for this one! One thing I don't think is reflected in Jim's return at the above link, is the commission charges for executed trades, or the short term capital gains one would have to incur on a winning pick. Yes, you would have to pay to buy the stock, then pay to sell the stock, and then pay the government if you made money on the stock. What a great arrangement, I wonder why Jim Cramer isn't recommending buying the stock of On-line brokerage firms who are making the money off of Jim's advice.

Is Jim Cramer doing any good for the general public? Hmm....I'll give this a

MAYBE. The reason for the maybe is that while he is giving specific recommendations that I think would be crazy to act on alone, he does provide market insights and sometimes backs up his recommendations with an explanation. However, this should only be the beginning of one's research into investments in general or a specific investment (if they have determined that they want to dabble in individual stocks, which I don't agree with in the first place). Do you think a lot of viewers are doing anymore due diligence with regards to what Cramer is saying...or seeking the individual advice of an investment professional? I don't.

So, what is my point?My basic point is this. America turn off your television, pick up a book (or read blogs like this one!), and learn. Is Jim Cramer the only offender of bad TV? No, but it was fun to highlight a show and drill down why it's bad for America to watch it.

On another note, if you would like to know my opinion on investing (not very valued, I know) here is the very, very simple version:

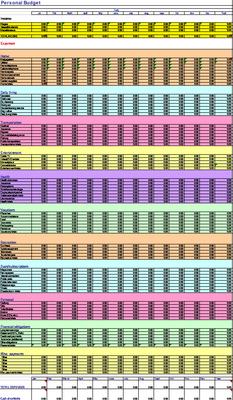

Spend less than you earn and pay off your debt if you have any.

If you don't have any debt, invest the remainder.

For short term goals, liquidity is your friend.

For long term goals such as retirement, buy passively managed, low fee ETFs or Mutual Funds.

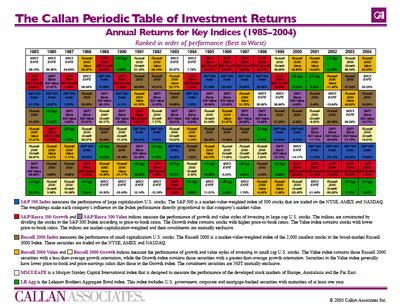

Allocate/Diversify these funds in different asset classes according to your risk tolerance and time constraint for being in the market. It's been proven that that your Asset Allocation Policy provides 91.5% of a portfolio's return (Financial Analyst Journal, May-June 1991). Also, according to the William F. Sharpe (Stanford Univ.) Study of 1990, 90.9% of a portfolio's return is based on the style selection (read Asset Class), compared to only 9.1% coming from the security selection.

Rebalance your portfolio once a year.

Sound off and let me know what you think!

PS - If anyone wants to sign up for ActionAlerts PLUS by Jim Cramer, it's $349.95 a year to get emails of what and when he trades. Sorry, I don't endorse it so I won't provide a link to it!!!